Managing corporate expenses can be a daunting task, especially for companies with large teams and international operations. Corporate credit card expense management software simplifies this process by automating and streamlining expense tracking, reporting, and compliance. In this article, we will explore how such software can benefit businesses, the features to look for, and the best solutions available.

Why Corporate Credit Card Expense Management Software is Essential

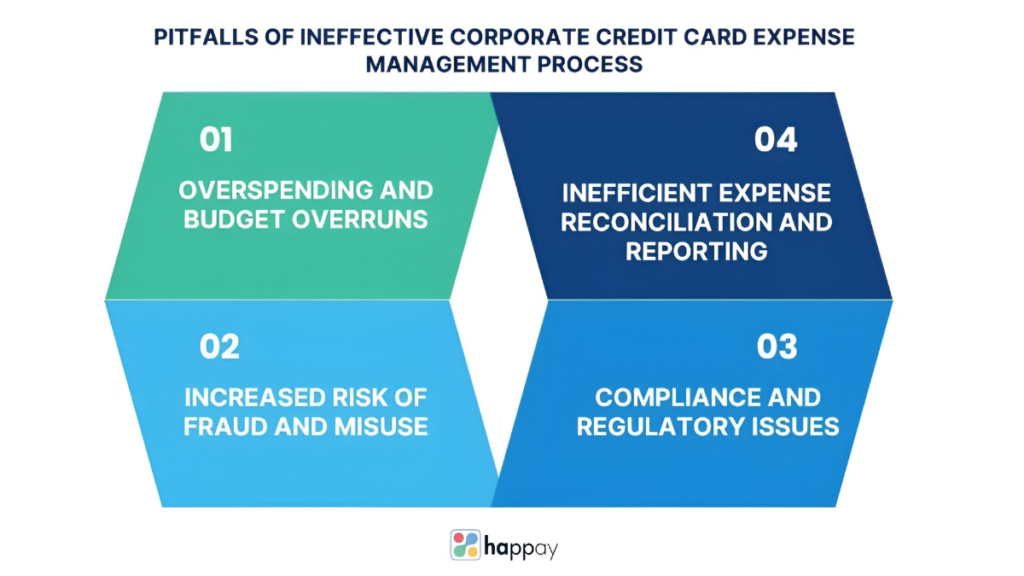

In today’s fast-paced business environment, companies need to manage expenses efficiently to remain competitive. Manual expense tracking is not only time-consuming but prone to errors. Corporate credit card expense management software automates the entire process, ensuring accuracy, reducing the risk of fraud, and giving finance teams real-time insights into spending patterns.

Key Benefits of Corporate Credit Card Software

- Automation and Accuracy One of the primary advantages of using corporate credit card expense Software is its ability to automate the tracking and reporting of expenses. By eliminating the need for manual data entry, the software ensures accuracy in expense reporting and reduces the possibility of human errors.

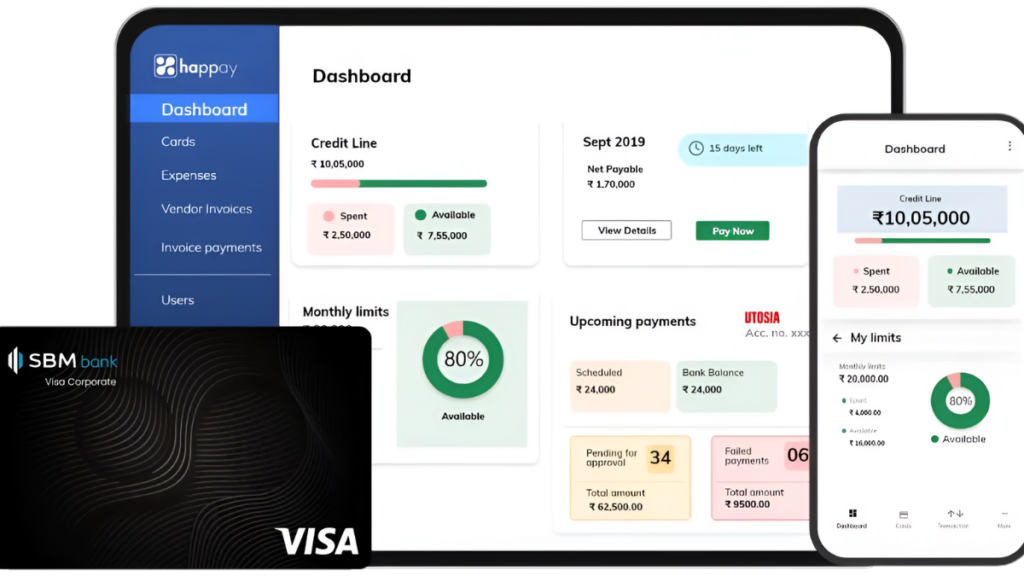

- Enhanced Visibility Businesses can gain better visibility into their spending with real-time reporting and analytics. With the software’s integrated dashboards, companies can monitor expenses across departments, regions, or even individual employees.

- Compliance and Policy Enforcement Expense policies can be embedded into the software, ensuring that employees adhere to company guidelines. This ensures compliance with internal policies and external regulations, helping businesses avoid financial penalties.

- Fraud Detection and Prevention With built-in fraud detection features, corporate credit card expense management software can flag suspicious transactions or deviations from spending norms, helping companies protect their assets.

- Time Saving for Employees and Finance Teams By streamlining the expense reporting process, the software reduces the time employees spend manually submitting receipts and reports. Finance teams can also benefit from quicker reconciliation and audit processes.

Top Features to Look for in Corporate Credit Card Expense Management Software

When selecting the best corporate credit card expense management software for your business, it is essential to consider the following features:

1. Integration with Accounting and ERP Systems

Seamless integration with accounting software and enterprise resource planning (ERP) systems is critical for smooth financial management. The best corporate credit card expense management software should synchronize data with platforms like QuickBooks, Xero, or NetSuite to ensure accurate financial reporting.

2. Multi-Currency Support

For businesses that operate internationally, multi-currency support is crucial. The software should automatically convert foreign currencies and apply exchange rates, ensuring that expense reports reflect accurate values.

3. Mobile Accessibility

Employees often incur expenses while on the go, making mobile access to the expense management system essential. Look for software that offers a user-friendly mobile app, allowing employees to submit receipts and track their expenses from anywhere.

4. Real-Time Reporting and Analytics

The ability to generate real-time reports is a key feature for businesses looking to optimize spending. Comprehensive dashboards and reporting tools provide valuable insights into spending trends, helping businesses make data-driven decisions.

5. Expense Policy Compliance

Software with built-in policy controls ensures that expenses align with company guidelines. For example, it can automatically reject expenses that exceed limits or fall outside approved categories, ensuring compliance with corporate policies.

6. Receipt Capture and OCR Technology

Optical Character Recognition (OCR) technology allows employees to take a photo of their receipts, which the software can then process and extract relevant information. This feature minimizes manual data entry and makes expense tracking more efficient.

7. Approval Workflows

Customizable approval workflows enable managers to review and approve expenses quickly. The software should offer flexibility to create approval chains based on the expense type, department, or employee role.

8. Secure Data Management

Given the sensitive nature of financial data, security is a top priority. The best corporate credit card expense management software should offer robust encryption, access controls, and compliance with data protection regulations.

Best Corporate Credit Card Expense Management Software Solutions

Several solutions on the market cater to businesses of all sizes, each with unique features and pricing. Below are some of the best corporate credit card expense management software options available:

1. Expensify

Expensify is a popular choice for businesses of all sizes, offering robust features such as receipt scanning, expense reporting, and real-time approval workflows. It integrates with major accounting software and provides multi-currency support, making it ideal for global companies.

2. SAP Concur

SAP Concur is an enterprise-grade solution with comprehensive features designed for larger organizations. It provides real-time expense tracking, integration with corporate credit cards, and automated approval workflows. SAP Concur also offers powerful analytics tools to help businesses manage their spending effectively.

3. Zoho Expense

Zoho Expense is a cost-effective solution for small to mid-sized businesses. It offers features such as receipt scanning, multi-currency support, and detailed expense reporting. Zoho Expense also integrates seamlessly with other Zoho products, making it a great choice for companies already using Zoho’s suite of business applications.

4. Certify

Certify is a user-friendly platform that offers advanced expense management features such as automated receipt capture, customizable approval workflows, and integration with popular accounting systems. It is a great choice for businesses looking for an intuitive and scalable solution.

5. Abacus

Abacus stands out with its real-time expense reporting and proactive expense policy enforcement. The software also uses AI to detect fraud and identify anomalies, ensuring that expenses are accurate and compliant with company policies.

How to Implement Corporate Credit Card Expense Management Software

Implementing corporate credit card expense management software requires a well-planned approach to ensure a smooth transition. Here are some key steps to consider:

1. Identify Your Business Needs

Begin by assessing your company’s unique needs and challenges. Determine the volume of expenses, the number of employees, and the complexity of your expense reporting processes. This will help you choose the right software that fits your business.

2. Train Employees

Once you’ve selected a software solution, it’s important to provide comprehensive training for employees. This ensures they know how to use the software effectively, from submitting expenses to adhering to compliance guidelines.

3. Integrate with Existing Systems

Ensure that the software integrates seamlessly with your existing accounting, ERP, and HR systems. This will enable automatic data synchronization and ensure that expense reports are accurate.

4. Monitor and Optimize

After implementation, continuously monitor the software’s performance and gather feedback from users. Look for areas of improvement and optimize the software settings to match your company’s evolving needs.

Conclusion

Investing in corporate credit card expense management software is a critical step toward improving your company’s financial operations. By automating expense tracking, enhancing visibility, and ensuring compliance, businesses can reduce costs, increase efficiency, and maintain control over their spending. With the right software in place, managing corporate expenses becomes a seamless and secure process, enabling companies to focus on growth and innovation.